US transformer manufacturers as well as project users need Congress to make sure that $1.2 billion happens to be included in the Senate-passed fiscal 2024 spending legislation so as to reverse a prominent U.S. shortage that remains in the bill since the funding differences with the House are being negotiated.

The fund is required to alleviate supply chain bottlenecks and at the same time support grid reliability as well as resilience throughout the transition to clean energy, said seven trade groups in a Jan. 4 letter that was sent to Senate leaders so as to meant to encourage bipartisan cooperation.

The letter happened to be inked by the American Public Power Association, GridWise Alliance, Edison Electric Institute, Leading Builders of America, National Electrical Manufacturers Association, National Association of Home Builders, and the National Rural Electric Cooperative Association.

It is well to be noted that the funding measures are up in the air as Democrats as well as Republicans went on to reach top-line agreements on Jan. 7, but individual appropriations bills when it comes to agencies now have to be negotiated amidst the partisan differences in terms of climate-related funding.

The CEO of GridWise Alliance, Karen Wayland, played down partisan opposition since the transformers are fundamental to the power grid. However, new sources of funding go on to include budgets that are more vulnerable to cuts, she remarked to ENR. The fights happen to be over numbers, and when one looks at the bottom line, $1.2 billion is a lot of extra money, she said.

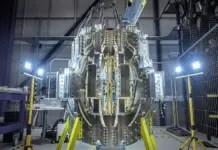

Stretched Thin

Wood MacKenzie, the energy research firm, remarked in a November 2023 evaluation that only around 20% of U.S. transformer demand can go ahead and be met by domestic supply, with prices going up 60% to 70% on average since early 2020 and lead times when it comes to large power installations now ranging between 80 and 210 weeks. In spite of a 2022 executive order from President Joe Biden so as to increase domestic production, funding is yet to get legislated, the firm said.

The chairman of the National Association of Home Builders, Alicia Huey, said that the new building and housing construction projects have been stalled and the utilities are not able to modernize the grid, said the letter. Soaring prices as well as shortages of electrical distribution transformers happen to be delaying housing projects and surging construction costs.

The Chicago-based NovaClean Energy CEO, Ben Pratt, noted a backlog that was closer to three years, he told Reuters. They realistically cannot hit the original commercial operation date, which they have been discussing with the buyers of power from company projects, he added.

It is well to be noted that record demand, a lack of skilled production labor, as well as challenges acquiring various components as well as materials, have stalled projects, the trade groups went on to say. The spending bill provision will boost financial aid, procurement, technical assistance, as well as workforce support, the letter noted, along with expanding existing funding authority in the Infrastructure Investment and Jobs Act for transformer as well as grid component investment.

The transformer manufacturing sector went on to be decimated by plants moving offshore, the Niskanen Center, the nonprofit public policy think tank, said in a 2023 report.

Last summer, in response to a U.S. Government Accountability Office report calling for actionable efforts by DOE so as to address transformer supply chain challenges, the latter said it would go on to have a plan developed by June 30.

The challenge, apparently, is set to get worse. Utilities went on to buy 1,300 transformers in 2020, remarked DOE, and demand is anticipated to, in fact, more than double that in 2027.

Fresh Investment

Companies are going ahead and investing to help alleviate shortages. A subsidiary of the U.S. manufacturer’s joint venture with Mexico-based Xignux, Prolec GE, went on to say in mid-December that it will spend $85 million in a new factory based in Monterrey, Mexico, so as to meet North American demand when it comes to single-phase pad-mount transformers. Construction is anticipated to begin in 2024, with operation in 2025.

The joint venture also went on to announce in 2024 an approximate $29 million expansion of a plant in Shreveport, La., so as to build more transformers for wind as well as solar energy projects that will be at a complete capacity by June.

John Bel Edwards (D), Louisiana Gov., said he applauds Prolec GE for recognizing the business growth opportunity that has been presented by the transition to cleaner fuel sources. It is well to be noted that the expanded facility happens to be located in the congressional district of Mike Johnson (R-La.), the House Speaker who has been quite a critic when it comes to added federal clean energy funding.

There also happens to be speculation that other leading worldwide manufacturers, like Germany-based Siemens AG, can go ahead and ramp up U.S. transformer capacity. There has never ever been a better time to invest in crucial electrical infrastructure as well as green mobility so as to support the backbone of America’s economy, said president and CEO Roland Busch from Siemens while announcing new investments in 2023 across the U.S. battery plants, semiconductor facilities, as well as electrical vehicle charging.